In the latest decoded Cone Link transmission, we explore the final Genesis vote results, the successful—re-instated—CNC/ETH Curve Gauge proposal, the great migration—for Liquidity Providers—and Omnipools’ imminent launch.

Conclusion of the Final Genesis Vote

On February 13th, the final Genesis vote, aka the liquidity allocation votes (LAVs), ended; these final weightings determined how liquidity would be allocated within each pool. Future LAV votes will occur fortnightly and be voted on by vICNC holders.

The final results for each underlying pool can be found below, along with the snapshot link; each vote met the required 256k vICNC quorum.

FRAX

FRAX+USDC—484K (40.44%)

FRAX+3CRV—463K (38.68%)

GUSD+FRAXBP—140K (11.72%)

BUSD+FRAXBP—110K (9.17%)

USDC

DAI+USDC+USDT—488K (44.59%)

FRAX+USDC—219K (19.98%)

FRAX+3CRV—215K (19.63%)

DAI+USDC+USDT+sUSD—173K (15.8%)

DAI

DAI+USDC+USDT—607K (55.62%)

DAI+USDC+USDT+sUSD—258K (23.61%)

FRAX+3CRV—227K (20.77%)

The Curve Gauge Prevails!

February 16th was a day of triumph for the previously killed CNC/ETH Curve gauge—we touched on the reasons why this proposal was killed back in September 2022 in the last transmission here—turn out required a minimum quorum of >30% with >51% in support, the proposal successfully secured 32.30%, 100% of which was entirely in support.

Following the conclusion of this vote, a new contract is enabled, which replaces the existing CNC/ETH LP contract with a new curve-based one that enables additional Curve (CRV) and Convex (CVX) rewards alongside the current Conic (CNC) emissions increasing the overall Annual percentage yield (APY) % for Liquidity Providers.

Overall a fantastic result with a strong turnout supporting the Conic proposal, highlighting significant interest from the broader ecosystem, something we feel will only compound after the Omnipools launch.

Migration Begins

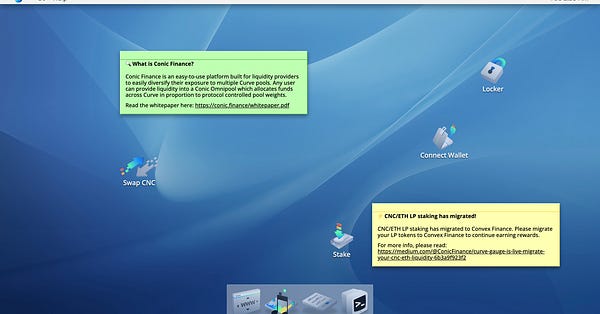

The new CNC/ETH Curve factory pool gauge went live on February 17th; the Conic Team dropped the announcement via Twitter, which included a medium article that covered a step-by-step guide on how to; correctly un-staking LP tokens from the retired contract and re-stake LP tokens directly on Convex Finance:

Please note all previously unclaimed CNC rewards can still be claimed in the old staking contract via the Conic UI. Additionally, the CNC/ETH gauge will not be eligible to receive CRV/CVX rewards for the first week that it is live. Following next week’s Curve gauge vote, LPs will start earning CRV and CVX in addition to CNC.

BUSD+FRAXBP becomes one with the force

Following the Genesis liquidity allocation vote that dropped on the 13th, the BUSD+FRAXBP Curve pool has seen some significant volatility—likely due to the recent New York Department of Financial Services (NYDFS) order for Paxos to cease minting Paxos issued BUSD—with the BUSD+FRAXBP liquidity decreasing from $12m → $1.59m. Therefore on February 20th, the Conic Team proactively set the BUSD+FRAXBP liquidity allocation to zero and distributed the allocation weight amongst the remaining three FRAX Curve pools, FRAX+USDC, FRAX+3CRV and GUSD+FRAXBP, by their final weighted proportions.

bb8, who created the governance post, highlighted this specific change was wholly isolated to the genesis LAVs, and in the future, weights determined by LAVs will be final.

You can see the full post: here.

DeFi’s Old Boy Deep Dives

Twitter user and Conehead 0xdaesu dropped a fantastic Conic Finance deep dive thread on February 21st; this thread includes several different perspectives on how CNC and vICNC will interact within the Curve ecosystem.

These perspectives include:

Potential Omnipool interactions between Frax, Maker and Synthetix and the influence these protocols currently have within the Curve Ecosystem. How they might utilise Omnipools to strengthen their protocols.

0xdaesu’s hope for future composability within Omnipools and the potential of yield-bearing tokens (ERC-4626 standard), which can be used for auto-compounding.

CNC emissions and the potential of an aggressive starting emission curve as a significant portion of LP incentives are expected to be distributed to players with the utmost belief in Conic, namely early adopters and protocols who fought for an omnipool.

Voting Boosts and how Conic is changing the game by not allocating boost on yield but boosts on vlCNC voting power.

Why becoming an essential player on Conic is valuable.

Bribe wars.

Stickier Liquidity, Versatility and how Conic prevents the need for LPs to shift often. This is due to the highest yield opportunities on Curve logically falling into one or more Omnipools.

The above-bulleted summary doesn’t do this thread justice, given the amount of detail and data that 0xdaesu has included, so go check it out:

CNC Tokenomics Update

The Conic Finance documents page was updated on February 22nd, which delves further into how future Omnipool LP stakers can earn CNC rewards.

Staking Omnipool LP tokens (25%)

Conic liquidity providers can stake their Omnipool LP tokens to earn CNC (in addition to CRV and CVX). All extra rewards earned by a Curve pool (e.g. FXS, SPELL) will be sold for CNC and paid out to stakers.

Rebalancing Curve pools (19%)

CNC emissions are given out to users who deposit into Omnipools while the pools are imbalanced, and the rebalancing reward period is active to incentivise regular deposits and withdrawals. The CNC received will be based on the amount deposited and will also increase over time while a pool is imbalanced and will stop when the pool is "balanced" again (within a deviation threshold).

With time, the amount of CNC paid out increases when the rebalancing reward period is active.

Launch is imminent

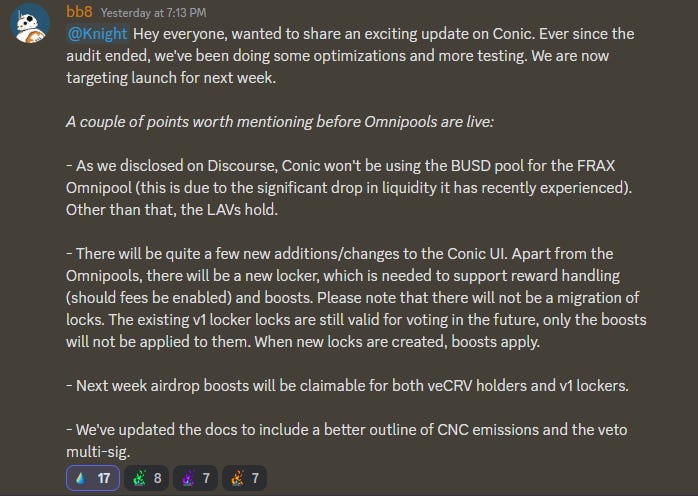

Feb 24th - For Conic holders who’ve not locked for vICNC or Coneheads whose locks ran out—and have yet to re-lock—you may have missed out on bb8’s announcement regarding the upcoming Omnipool launch; that’s right, the team are moving forward targeting next week as go-live.

This news was very well received in the #vote-lockers discord channel—which is only visible to vICNC holders who have verified via collab land—as this has been a long journey, especially for our fellow Coneheads who have been part of the discord since pre-community raise.

We’re incredibly excited to be at this point, especially considering the subsequent decoded Cone Link transmission will be post-launch as the Omnipools will be live!

So we would like the opportunity to thank the community, who have been—in most cases—very supportive of the team, giving them the breathing room and patience to build, and we wish the team the best of luck for launch day!