Feb 10th - The Rise of Omnipools

A Conehead does not act for personal power or wealth but seeks knowledge and enlightenment.

In the latest decoded Cone Link transmission, we explore the final pre-launch governance votes, unkilling the CNC/ETH Curve Gauge proposal by the Conic Finance team, audit completion and the Omnipools’ engines powering up!

Feb 3rd - Audit Report Complete

Team Member 0xWicket leaked that the Audit report was due to be released very soon, and no specific date was mentioned, but with the Omnipools launch imminent, we knew to expect it any day now.

Then in typical Conic Finance fashion, the team subtly added the audit report to the website yesterday. This was caught by Conic Intern, who immediately tweeted out and notified any unaware Coneheads in the discord as well:

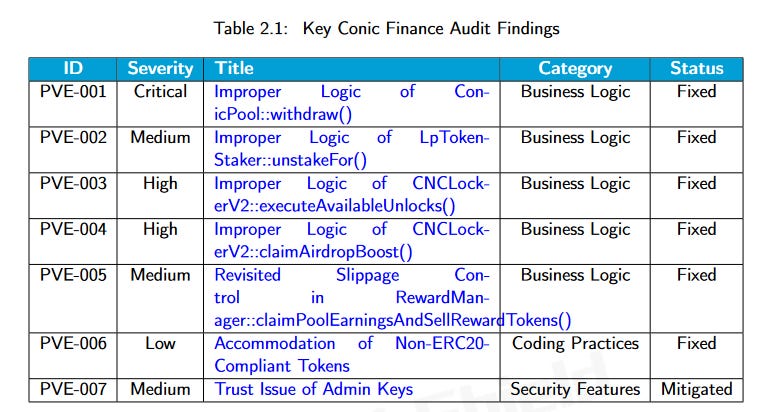

The Audit was completed by Peckshield and in summary, section “2.1 Summary of Findings” shows that there were seven identified findings:

1 Critical

2 High

3 Medium

1 Low

The report confirms that all of these findings have either been fixed or mitigated by the Conic Team, and Peckshield even went as far as to say that the “smart contracts are well-designed and engineered”, which is excellent to see. For those who are more technically minded or those who would just like to read the full breakdown of the report—we highly recommend you take a look—you can find it here.

Feb 5th - Pick your Platform

The 31st saw a follow up governance vote to the previous “Bribe recipients” vote that was mentioned in the last Cone Link transmission here. This new vote was raised to determine which platform would be utilized for paying future CNC bribe rewards to vICVX holders.

The two protocols included were Votium and Quest, on Feb 5, the vote concluded with Coneheads unanimously opting for Votium. The breakdown of the final results were as followed:

Votium—537K (98.66%)

Paladin Quest—7.3K (1.34%)

Quorum—544K / 267K

Feb 8th - Unkilling the killed Gauge

Conic Team member R2D2 raised a proposal on the Curve Finance governance forums to re-instate the previous CNC/ETH Curve gauge (#unkillthegauge), which would enable Curve incentives on the pool.

As longstanding Coneheads will already know, the Gauge proposal was raised initially back in September 2022—by an individual who is rumored to be affiliated with the Curve team—and required >51% support and >30% quorum. At the time, the proposal passed—with 98.44% in support and 55.85% quorum—but the Conic Team felt it was premature as the Omnipools were not yet ready for release.

So we can now deduce that, with the team pursuing the unkilling of the original gauge and audit completed, the Omnipools must be imminent.

For any Coneheads or readers who aren’t aware of what a Curve Gauge is or how it works, it means that, if approved, existing CNC/ETH Liquidity Providers will be able to stake their LP tokens directly on Curve or Convex and continue earning CNC as well as additional rewards in both Curve (CRV) and Convex (CVX).

You can read the specifics on the Curve forum linked in the tweet above but a summary overview of why the team are now choosing to re-launch the Curve gauge proposal is as followed:

The Conic audit has been completed and the report will be published over the coming days.

The initial “Liquidity Allocation Vote”—or LAV for short—to determine the weight distribution for the Conic Omnipools will start this week and once this is completed, Conic is essentially ready to launch.

Currently CNC rewards are distributed to CNC/ETH Curve pool LPs that stake their LP token in the

AMMStakercontract (the Conic rewards contract). This contract will be shut down as soon as CRV incentives are enabled. CNC rewards will then be distributed as extra rewards via the gauge, as well as paid out via Votium to vlCVX holders.It would be ideal if CRV incentives are enabled before launch, such that the current

AMMStakercontract can be shut down properly (opposed to attracting more liquidity post launch and then requiring LPs to migrate to Curve/Convex).

Feb 8th - Final Genesis Vote Commences

In the Conic discord, the team made the Coneheads aware that the pending final Genesis votes, which will determine the liquidity allocation weights for each Omnipool at launch, was set to go live on February 8th.

The genesis liquidity allocation votes (LAVs) are now live and will conclude this Monday. There is currently a LAV for each Omnipool that will be live at launch with the following pools being available for liquidity allocations.

FRAX LAV: FRAX+3CRV, FRAX+USDC, GUSD+FRAXBP and BUSD+FRAXBP

USDC LAV: DAI+USDC+USDT+sUSD, DAI+USDC+USDT, FRAX+3CRV and FRAX+USDC

DAI LAV: DAI+USDC+USD+sUSD, DAI+USDC+USDT and DAI+USDC+USDT

Quorum for each of the votes requires greater than 255k vICNC votes.

R2D2 confirmed in the Curve gauge proposal that once these votes are completed, Conic is ‘essentially ready to launch’. Going forward there will be bi-weekly LAVs to determine the target allocation weights. For a detailed overview you should refer to the whitepaper.

9th Feb - Enabling CRV incentives for the CNC/ETH pool

Following R2D2’s governance proposal to enable CRV incentives for the CNC/ETH pool, an official DAO vote began. If this vote is to pass, CNC/ETH liquidity providers will start earning CRV and CVX in addition to CNC rewards

10th Feb - MEXC likes the Droids

Today sees MEXC announcing Conic Finance joining their exchange listings, with the amount of interest over the past month, there have been several exchanges in the Telegram, and Discord channels, offering discounts—that the team have had no interest in—but MEXC was one of the first who showed genuine interest in listing Conic for free, a first of many no doubt!

The CNC/USDT pair will open for trading on February 13th in the MEXC Assessment Zone, to find out more, check out their tweet below: