V2 Launch Is Upon Us

Diving into the Launch Proposal Details + the Final Launch vote!

In this latest transmission, we break down the Conic v2 Launch Proposal, looking at each section, what it means moving forward, and the Final Pre-Launch vote!

Conic v2 Launch Proposal Unveiled

On the 9th of Jan, our questions about the launch of V2 had answers, as the droids dropped the finalized Launch Proposal. Following December’s series of decisive DAO votes, which concluded on the 29th, the vlCNC cone heads set the stage for a new era, the V2 era—with the culmination of these votes establishing the initial parameters for the eagerly awaited v2 Omnipools.

Enhanced Robustness

At its core, Conic v2 promises a user experience akin to Conic v1 but heavily focuses on robustness and security. The droids have announced several new security features to enhance the protocol's resilience, which is obviously great to see, and we will touch on some of these below.

Exploring New Frontiers

Firstly, let’s discuss Liquidity Allocation Modules (LAMs)—introduced as one of the core features v2—these modules act as gateways for scaling Omnipool liquidity across the market.

Obviously, the default Curve&Convex LAM from Conic v1 remains, but the droids have now introduced flexibility to include additional LAMs supporting various rewards or services. This will be added via the Community Improvement Proposals (CIPs) process.

How do LAMs work?

An example provided by the team was an “Omnipool that could contain a LAM supporting PRISMA rewards or one that offers peg-keeping as a service with crvUSD. Both are novel and interesting additions—especially the peg-keeping route in which the Curve Team has previously shown great interest—the Conic droids envision LAMs as a gateway to scaling Omnipool liquidity across the markets.

Bonding

What about bonding? Well, it empowers liquidity bootstrapping. For Coneheads that don’t know, Bonding was first coined by Olympus DAO, who introduced the bonding mechanism to bootstrap the DAO liquidity. It’s where the (3, 3), meme came from—referring to the protocol’s game theory.

It effectively used bonding to incentivize users to deposit or sell their collateral to the Olympus treasury in return for discounted OHM tokens. This concept was massively successful, with OHM hitting an all-time high of $4 billion in market capitalization.

So how does this mechanism fit into V2? Well, as an addition, it enables holders of crvUSD Omnipool LP tokens (cncCRVUSD) to bond their tokens, receiving a—linearly increasing—discounted vlCNC in return.

These vICNC are obviously locked, ranging from between 4 to 8 months, and this bonding will only be active for the first 52 weeks. The received cncCRVUSD LP tokens will get staked on Conic to earn CRV and CVX—which ties into the reimbursement plan—before gradually being streamed as rewards to vlCNC holders.

400,000 CNC in total will be allocated to the bonding mechanism. These funds will be allocated from the Conic treasury and won’t affect the inflation schedule.

Fees

No longer will we hear “wen fees”, with the introduction of a 10% platform fee on CRV and CVX earned by a V2 Omnipool, which should help nurture the growth and sustainability of V2.

Straight out of the gates, the initial fees will be directed entirely to the debt pool; these fees will progressively transition to benefit vlCNC holders.

We’ll hold fire before speculating on the potential fees that could be generated by V2, as it’s more important for us to be focused on the launch!

Locker Migration

Conic v2 introduces a new version of the vlCNC locker, necessitating migration. The loyal Cone Heads who had CNC locked during the protocol shutdown are in for a treat with an airdropped vlCNC boost when relocking in the new locker, providing a unique boost opportunity within the first 6 months.

This is very similar to the original vICNC boost introduced for V1—the difference being that earnings from bonding will be paid out to vlCNC holders using their boosted balance.

The airdropped boost amount will be based on the vlCNC balance in the current locker (i.e., it will be based on the historic CNC amount locked and lock time boost).

Reimbursement

Platform fees and rewards from staking unclaimed cncCRVUSD LP tokens will be channeled to the debt pool for the first year. A transparent debt token mechanism will enable LPs affected by past exploits to claim their share, providing redemption options within the Conic UI.

The parameters for debt token claiming and tokenomics are outlined as follows:

Total supply: 4,337,233

6 month claim period

Claimable balances (i.e., affected users’ share of the debt pool) are based on the USD value lost at the time of exploit.

CNC Inflation

After a DAO vote on August 2nd led to the pause of CNC emissions to Conic Omnipools, Conic v2 signals the re-enabling of CNC inflation, picking up where it left off.

The Guardians of Governance

Ensuring Governance and Representation V2 introduces Guardians, whitelisted addresses with the ability to pause an Omnipool temporarily, are introduced for added security. The proposed Guardians include key figures within the Curve ecosystem.

Additionally, v2 enables vlCNC holders to delegate voting power, fostering a decentralized governance structure.

Restrictions and Rebalancing

Conic v2 is adopting a valid cautious approach by disabling the use of flash loans unless whitelisted through a governance vote. Rebalancing rewards will be disabled by default, requiring a DAO vote to activate after 4-6 weeks based on Omnipools' Total Value Locked (TVL).

The Journey

The Conic team closed the proposal by expressing gratitude to both auditors (ChainSecurity and MixBytes), the Curve team, and the Coneheads. The launch of Conic v2 has been a long-awaited and highly anticipated chapter in the protocol's evolution.

In summary, the Conic v2 launch proposal is a comprehensive roadmap for the next significant and exciting steps for Conic Finance, blending previous Omnipool familiarity with additional innovative features.

At Cone Link, we’re very excited about what comes next!

Conic Launch Vote

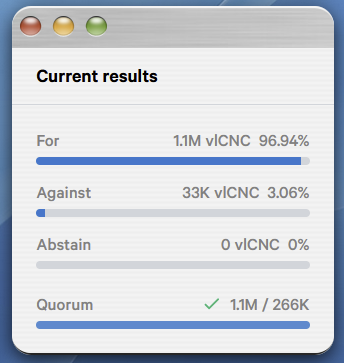

On the 10th of Jan, the final vote has been deployed. This vote will determine whether Conic V2, in its current proposed format, will go live.

The end date is Jan 15, 2024, and for a quorum, a minimum vote of 266K vICNC is required.

It’s safe to say that the quorum has been met, and there was most likely never any doubt that this proposal would pass—with a massive 96.94% in favor.

Bb8 dropped into the discord on the 9th to confirm that once the vote concludes, V2 would launch 1 week later:

Therefore, we should see the protocol live at some point during the week starting January 22nd.

We’re almost there, Coneheads; this is the home stretch!