A new transmission has finally been decoded, here is the transcript of an unrevealed State of Pools.

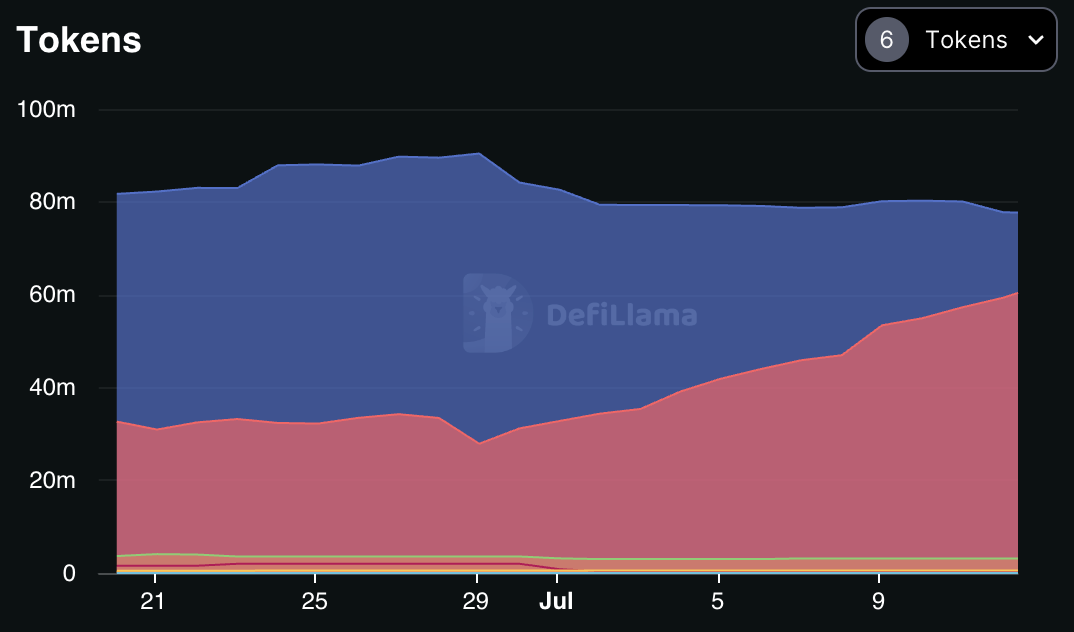

TVL

TVL has grown by $20m (+18%) since June 20, reaching $142m. The bullish trend is intact, this is largely attributed to the exponential growth of a new fuel, the crvUSD OP.

vlCNC

vlCNC supply has contracted by around 97k vlCNC (-6.5%) since the end of the last LAV on June 20th.

At present 1.389m CNC are locked, i.e. 24.66% of the total supply. 1 vlCNC controls $103 of liquidity based on current TVL.

As a result, we see that the number of voters has reduced during the last LAV, from 1.4m to 1.2m vlCNC at maximum.

CNC/ETH pool

The CNC/ETH Curve pool gained $400k since the conclusion of the last vote, there is now $5m of liquidity in it.

The pool is balanced and the projected yield is about 25% on Convex (13.5% paid in CRV/CVX and 11.6% in CNC).

June volume is $7.8m, down 15% MoM. Perhaps the relative lack of volume potentially signals an aversion to sell CNC from some of Conic's LPs.

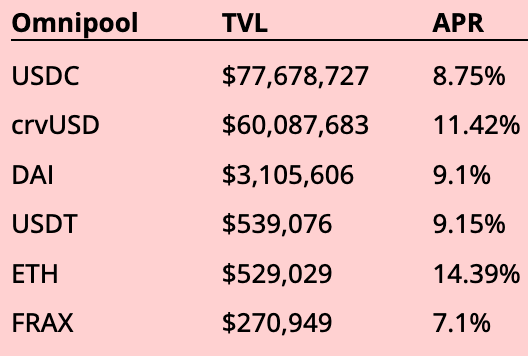

Further analysis focuses on the behavior of Omnipools.

crvUSD Omnipool

Since the last State of Pools, the TVL doubled from $32.1m to $59.1m. The crvUSD Omnipool now holds 68% of crvUSD supply. The yield stays in the upper reaches between 12% and 18%.

Regarding the liquidity allocation weights (LAW), some changes happened. TUSD-crvUSD has been blacklisted following a governance vote by the Conic DAO due to recent turmoils. Consequently, its LAW had to be set to 0 following the activation of the results of the last LAV. Rebalancing incentives worked perfectly and the bots rebalanced the various Omnipools within hours.

The FRAX-crvUSD benefits from this as the newcomer of the crvUSD OP with a 13.8% LAW to start, just above USDP-crvUSD (11.2%) but still with 7.3 pts less than the LAW of the deceased TUSD-crvUSD pool. This is just the first LAV for the FRAX-crvUSD pool so let's leave time.

The USDT-crvUSD pool also takes advantage of this upheaval by earning 8.5 pts bringing its LAW to 35.1%, no longer very far from that of USDC-crvUSD. The latter still leads the discussion with 3.8 pts gained LAV-to-LAV pushing its allocation close to 40%.

It will be interesting to observe if the FRAX-crvUSD pool will be as much incentivized as its counterparts USDT and USDC, at first glance no because it's not a Curve pool used by the peg keepers. But who knows what will happen if Frax decides to join the party with its voting power?

Let’s see if the FRAX-crvUSD’s LAW can fight with the two monsters, and especially if an indisputable winner emerges from this war.

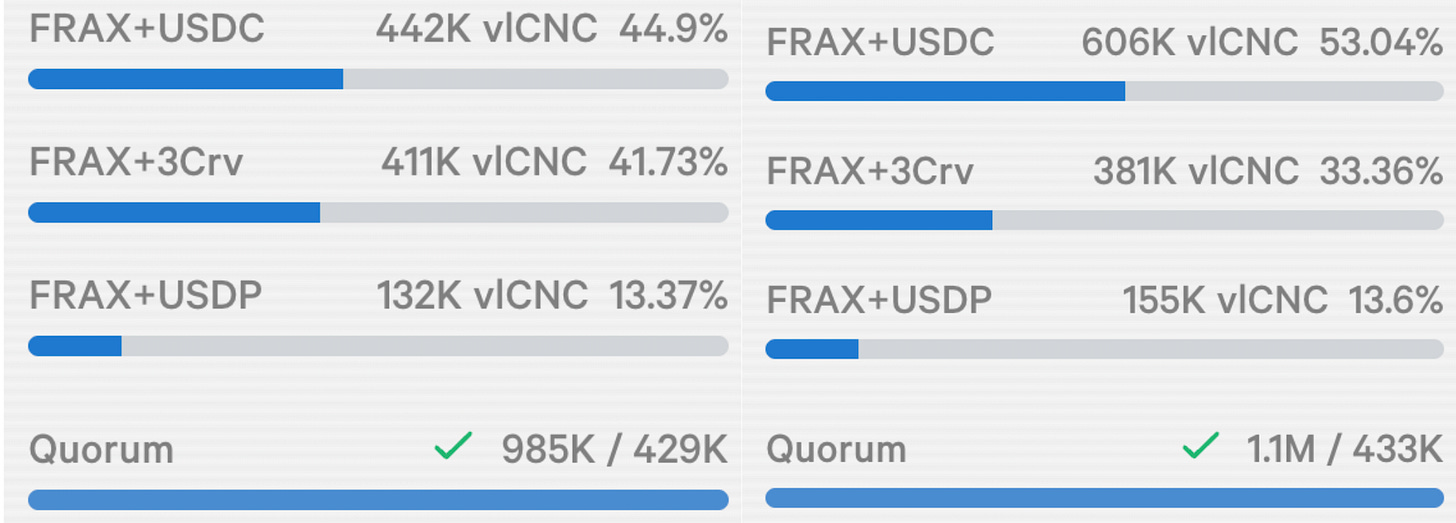

FRAX OP

Well, this is not ideal.

The FRAX OP doesn’t turn things around. TVL is down only, sitting at $270k.

Why? the data points to the yield that is much lower that of other OPs.

As shown in the graphs, this is due to a reduction of the CRV/CVX yield of the FRAX-3CRV and USDP-FRAX pools belonging to the FRAX OP.

So to reverse the trend without depending on Frax's willingness to increase the voting power deployed on these pools, other FRAX pools generating a higher yield could be added by a governance proposal (eUSD-FRAXBP e.g.).

FRAX-USDC gained 8.1 pts to propulse itself at 53%, comfy in the lead.

FRAX-3CRV is the one to suffer, losing around 8 pts while FRAX-USDP's LAW remained stable around 13%.

USDC OP

The USDC Omnipool is the greatest satisfaction from Conic, the liquidity remains sticky despite some yield fluctuations. This proves how an Omnipool can play the role of a very competitive savings account offering more than Treasury bills.

As in the FRAX OP, FRAX-USDC accelerated here with 8.4 pts gained, closer and closer to 50%. Coincidentally, FRAX-3CRV lost 8.3 pts, with only 14.7% allocated. In other words, the FRAX pools rule the USDC OP with a cumulative allocation of 59.5%.

MIM continues its ascent with 3.2% more liquidity allocated to the MIM-3CRV pool. 23.5% of the votes guarantee second place in terms of liquidity obtained, but this is still 21% less than the liquidity directed towards the FRAX-USDC pool. A gap has opened up and a gap of the same size exists between the first two FRAX OP’s pools.

The free fall continues for 3CRV which lost 3 more points giving it the last place with 7.2% of the votes. The sUSD-3CRV’s LAW stayed flat close to 10%.

It’s official, the USDC-crvUSD and USDT-crvUSD pools have been whitelisted for the USDC and USDT OPs and will participate in the next LAV.

This confers a new power to the USDC OP, that of being one of the guarantors of stable external liquidity provision for crvUSD.

Since external liquidity impacts the debt of peg keepers, the USDC and crvUSD OPs could be efficient tools to influence the interest rate of crvUSD as they can provide direct injections of single sided USDC and USDT deposits to their respective crvUSD pools.

If you want to go into details, I wrote about this synergy here.

Of course if Curve wants to use the liquidity of these OPs for its purposes, it requires some vlCNC voting power, let's see how they will get it.

USDT OP

The facts tell us that the FRAX-3CRV pool has a LAW of 42% and its yield is declining. Its allocation is also down 5.6 pts. MIM’s LAW has taken the lead, up 8.3 pts to 42.7%.

3CRV’s LAW decreased to 15.28%.

The presence of the USDT-crvUSD Curve pool will diversify the risk profile of the USDT OP. The market having shown confidence in crvUSD, its arrival should be welcomed.

Furthermore, with a decent allocation, its 9%+ yield would provide a boost to the USDT OP APY. Interest will be focused on the impact of USDT-crvUSD on USDT OP’s deposits.

DAI OP

MIM’s LAW gained 10 pts (36.1%) and it is now a hair ahead of FRAX-3CRV (35.6%) at the top of the DAI OP. The cards have been reshuffled by MIM as the pool that receives the most liquidity in two different Omnipools (DAI and USDT).

MIM's liquidity gain thanks to Conic gives us an idea of the potential efficiency of a bribe market that would allow direct liquidity acquisition through the voting power of the vlCNC holders.

Let's continue, FRAX dropped the lead, losing 5 points but still holding 35.6%. This is 20 points higher than the sUSD’s LAW (14.7%).

The 3CRV pool is also the last position in this OP, 13.5% of the liquidity being allocated to it.

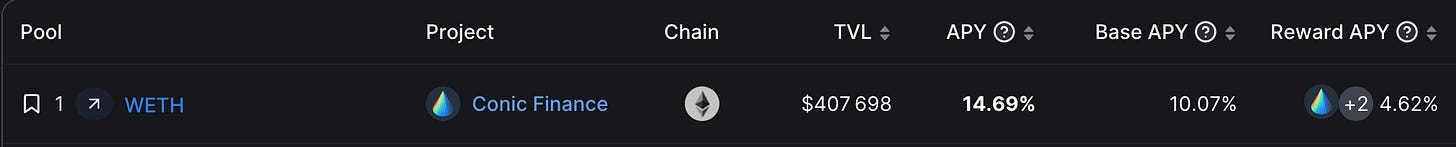

Now let’s focus on an Omnipool awaited by all, freshly launched this Monday (and audited).

ETH OP

All the staked ETH pools that meet the criteria have been added, namely stETH/ETH, cbETH/ETH and rETH/ETH.

The initial LAWs are as follows :

It makes sense that stETH is already dominating as it is also largely the case in the LSD war. The stETH/ETH pool’s LAW stands at 60.6% while the market share of stETH is 74.3%. cbETH ends up with a respectable allocation of 23.2%. Despite the fact that it is a LSD issued by an exchange, its market share is the 2nd highest with 11%. RETH by Rocketpool only gets 16%, personally I expected a larger LAW for the most decentralized LSD but this is only the first vote.

This combination allows the ETH OP to offer a return of around 15% to its LPs.

This is already the best yield available in DeFi on a single side deposit of ETH.

It is important to specify that the LP tokens of these pools go up in value relative to the underlying ETH in the form of rebases (stETH) or increasing ETH value (cbETH, rETH). Theoretically there is no impermanent loss because LPs will be able to withdraw more ETH at the end. So the base APY of the ETH OP displayed on Conic features the staking yield of approximately half of ETH that are deposited, Curve pools’ trading fees and the positive slippage earned by the ETH OP.

Frax’s LSD, frxETH, can’t belong to the ETH OP for now because it lacks a Chainlink price feed. This advancement could allow the addition of new high-yield pools (frxETH/ETH and stETH/frxETH e.g.). I heard that Frax is working on it.

The ETH OP being the first with a volatile underlying asset which is also the most used in DeFi, is one of Conic's flagship products. The yield will be one of the highest on the market, the exposure is diversified through the safest LSDs in DeFi, LPs are protected and earn on top of this a governance token which gradually increases the liquidity they control. The cocktail looks promising.

Distribution of Conic’s TVL

FRAX-USDC is the Curve pool that receives the highest share of the total liquidity deposited on Conic with 24.2%, which amounts $34.3m (up $3m LAV-to-LAV).

The liquidity allocated by Conic’s OPs to the FRAX-3CRV pool has fallen from 32.1% to 9.2% since the first LAV in June and is down $8.4m LAV-to-LAV.

3CRV’s liquidity share was 29.6% two LAV ago, it is now only 4.4%.

MIM-3CRV is allocated almost $20m from Conic, up $1.8m LAV-to-LAV. This represents 25.3% of MIM-3CRV’s liquidity on Curve.

The crvUSD pools are already among the most popular on Conic, 42.3% of the global liquidity is now allocated to these new pools.

The share of crvUSD-USDC (17.3%) may aim for the lead as it is expected to increase thanks to the future allocation of liquidity from the USDC OP.

The next vote starts this Thursday and ends next Tuesday. The evolution of the ETH OP and the potential flippening between the crvUSD OP and the USDC OP will be closely monitored.

See you at the next decryption.