A different transmission has been intercepted, the message looks cryptic.

"State of the Pools". What does it mean?

The content has finally been decrypted, the technology of Omnipools and their evolution are scrutinized in faraway places and each change made by the people of Conic is dissected. We had been trying to get our hands on these studies for a while. Finally we intercepted one.

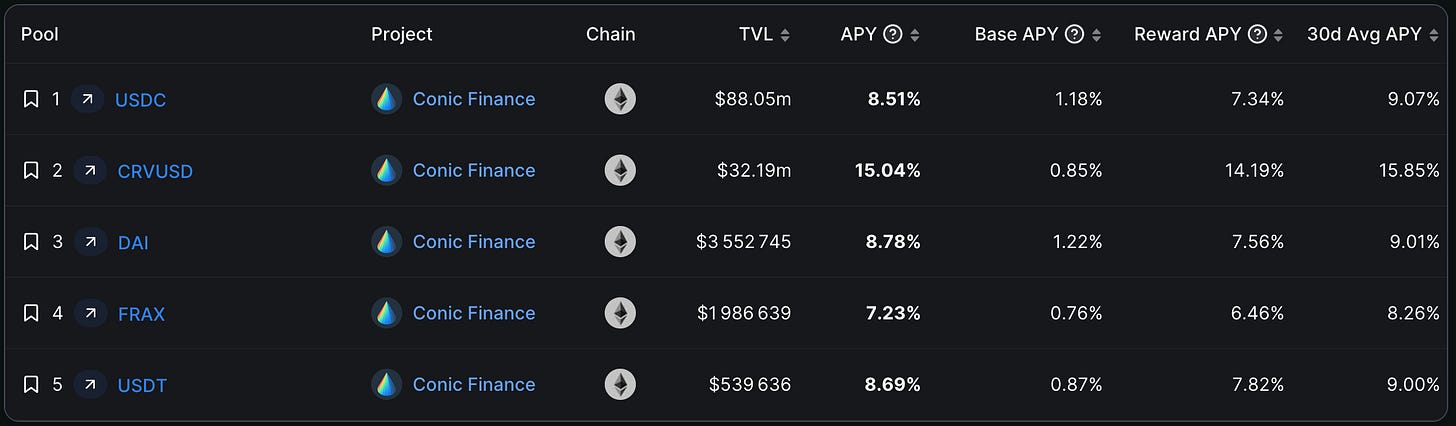

The analysis begins with some statistical data on the state of Conic.

TVL and the median APY

The TVL and the median APY receive a real boost thanks to the introduction of the crvUSD Omnipool. Since the conclusion of the last LAV on June 6, Conic’s TVL has increased from $104m to $126m (+21%). The median yield is back in 9-10% territory.

Reshuffles between the OPs didn’t go unnoticed. Some LPs migrated from the USDC OP to the crvUSD OP to benefit from its higher yield.

Yields declined slightly relatively to their 30D APY due to volatility in reward token prices. Conic still offers one of the best yields in DeFi for stablecoins. We will come back to the value proposition of the crvUSD OP later.

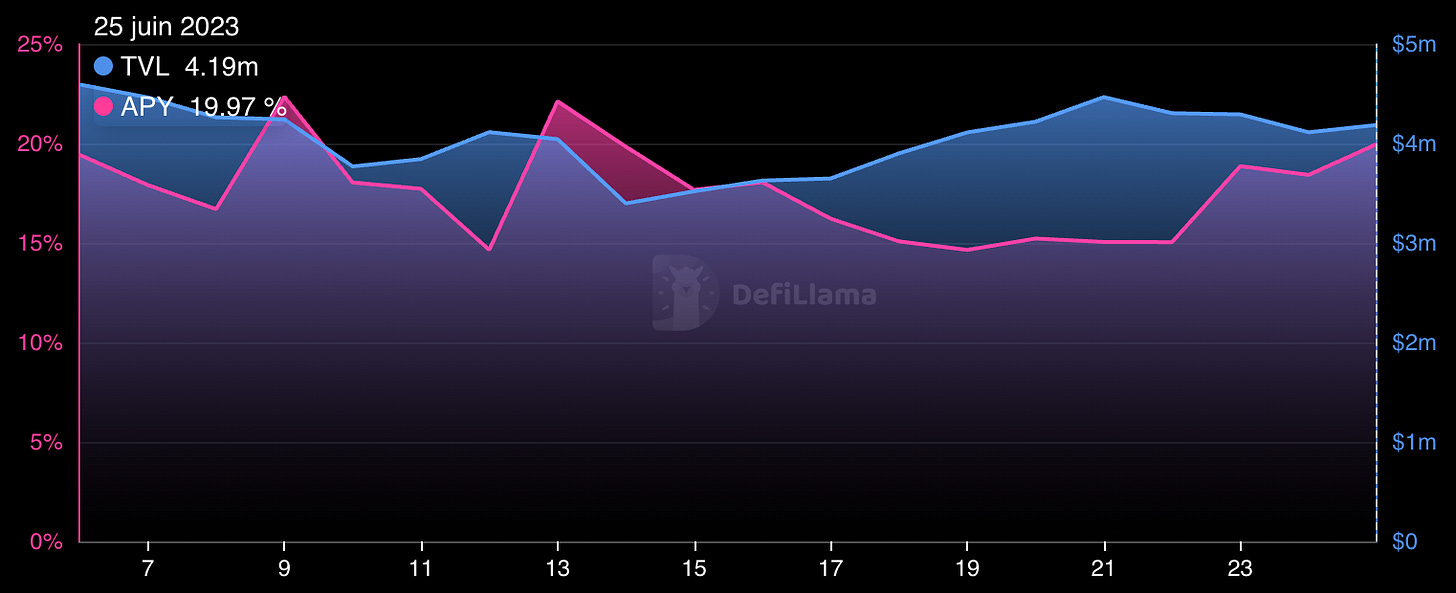

CNC-ETH pool

The CNC-ETH pool’s liquidity stays flat just above $4m LAV-to-LAV. The APY oscillated between 15% & 20% once again due to the market volatility and trading activity.

vlCNC

Not much movement regarding vlCNC. For the moment, there was no significant lock or unlock in June. Currently, 32.3% of CNC's supply is locked, bringing the vlCNC supply to 1,48m.

The rest of the research is based on the Liquidity allocation weights’ (LAW) changes resulting from the last Liquidity Allocation Vote (LAV).

Changes of a magnitude rarely seen before took place during this vote.

USDC OP :

The first thing that jumps out at you is the MIM’s LAW. It’s up 2.53x from 8% to 20%.

What is interesting is that it only took 135k more votes (97% increase) to reach this level.

The other winner of this LAV is sUSD whose LAW increases from 4.65% to 9.97%. This is the first time MIM & sUSD reach such high LAWs in the USDC OP.

FRAX pools were challenged but held on. FRAX-3CRV which had the highest allocation in the previous vote, is now seriously hounded by MIM, just 3 points behind. FRAX-3CRV’s LAW collapsed from 31% to 23%, a 25.9% decrease.

FRAX-USDC is now in the lead, up 9.6 pts from 26.6% to 36.3%. So the combined allocations of FRAX pools represent 59.47% of the USDC OP. This figure was at 57.92% before this LAV, so pretty stable.

DAI is the big loser of this LAV. The 3CRV pool’s LAW is down almost 20 pts from 29.4% to 10.3%. DAI which has always monopolized the top 2 in the USDC OP, now finds itself in 4th position behind MIM and heeled by sUSD.

DAI OP :

We take the same ones and start again.

There is a big breakthrough for MIM & sUSD whose allocations have been multiplied by 3.42 and 2.88 respectively.

FRAX-3CRV’s LAW increased by 2 pts to 40.28% and took over the lead of the DAI OP.

3CRV’s LAW crumbles here also, divided by almost 3. From leader of the DAI OP at 48.3% to the bottom of the table at 16.73%. Surprising.

FRAX OP :

In the FRAX OP, there is not as much change in allocations, but there is in leadership.

FRAX-USDC took control by gaining 2 pts while FRAX-3CRV let go of the reins by conceding 6.7 pts. FRAX-USDP’s LAW made an interesting step forward by increasing from 8.63% to 13.37%.

USDT OP :

Expansion is the word of this LAV for MIM. MIM-3CRV’s LAW rises 4.54x and now stands at 33.6% in the USDT OP. Contraction is that of DAI’s LAW which was divided by 2.82.

FRAX-3CRV also took the opportunity to take the lead in this OP with an allocation of 48.3% from 41.8% the previous LAV.

crvUSD OP :

It's the new kid's turn. The launch of this Omnipool was a success for Conic, currently 82.5% of the crvUSD supply ($38.9m) resides in the crvUSD OP ($32,1m).

This is explained by Conic's value proposition, namely to offer a higher yield than that of Convex and an exposure to different Curve pools paired with the same underlying asset. LPs want to benefit from the trading fees of each crvUSD pool used by peg keepers. They cannot predict the usage and CRV emissions received by these pools. Therefore, depositing into a crvUSD Omnipool makes a lot of sense.

Regarding the vote, we can see that crvUSD-USDT saw its LAW reduced by 14 pts, especially to the benefit of crvUSD-USDP and crvUSD-TUSD which gained 11,4 pts and 6,7 pts respectively.

The crvUSD-USDC pool’s LAW is now over 35%, 10 pts ahead of crvUSD-USDT. This could look like a repricing of USDT risk closer to that of USDP & TUSD following the recent USDT FUD.

The crvUSD-FRAX pools will be added to the crvUSD OP in the next LAV. Some votes are in progress on Curve to add crvUSD-DAI and crvUSD-sUSD pools. Soon more newcomers?

Conic TVL distribution :

There are quite a few conclusions to be drawn from this graph.

Some pools have seen an exodus of conic liquidity allocated to them.

3CRV lost $25.5m, FRAX-3CRV $15,7m. This is really significant as it represents a liquidity loss of 73,4% for 3CRV and 42,3% for FRAX-3CRV LAV-to-LAV.

Fortunately for FRAX, the FRAX-USDC pool did not lose liquidity, it even gained $1,82m more. But the global liquidity allocated to FRAX pools decreased from $66,8m to $52,85m, a reduction of $13,95m (-20,8%).

On the other hand, MIM shines by allocating $8.8m more (+97,9%) to its MIM-3CRV pool. sUSD is also doing very well with $3.6m more (+70,2%).

This LAV was very interesting and created profound changes in the structure of Omnipools. The crvUSD OP made a remarkable entrance as the second most capitalized Omnipool barely two weeks after its launch.

Will the empire strike back? Answer in the next intercepted State of Pools.

Oh by the way, the ETH Omnipool consisting of ETH-pegged Curve pools is only days away from release. Exciting.

datas are provided by Defi Llama, Conic, Convex and degenerate_defi’s dune dashboard.