In this latest transmission, we look at Curve Finance’s StableSwap-NG, crvUSD growth, and the latest status of Conic audits.

StableSwap-NG

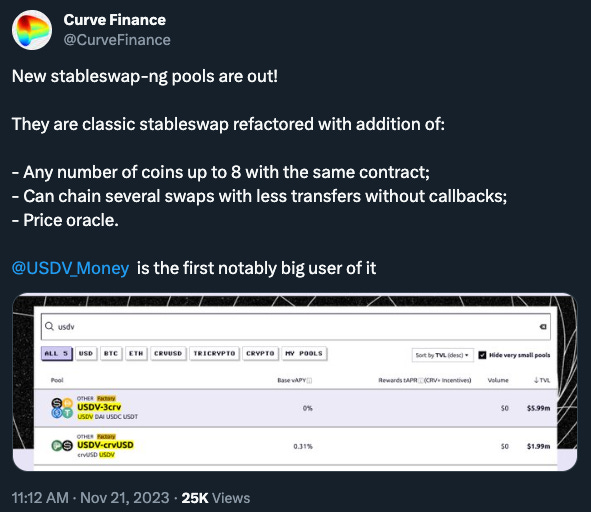

Curve continues to bring innovation in the space, with the introduction of the StableSwap-NG AMM infrastructure (NG standing for “New Generation”), which represents a technically enhanced iteration of the previous StableSwap implementation.

We remember with nostalgia when, just 4 years ago, Michael Egorov, alias “Mich”, published the StableSwap WhitePaper, and with it would build the foundation of the Curve Ecosystem, at the epicenter of what DeFi is today.

Well, a few days ago on 25 October, the elite devs of the Curve team deployed the StableSwap-NG contracts, and on 21 November, new pools using the revamped AMM popped out of the void.

It is exciting to witness the continued development of the core infrastructure on top of which Conic is building! If you want to learn more about StableSwap-NG, we recommend reading the initial Curve Finance thread:

Additionally, for an in-depth review, check out sir Curvecap October 26th coverage:

$crvUSD keeps maturing

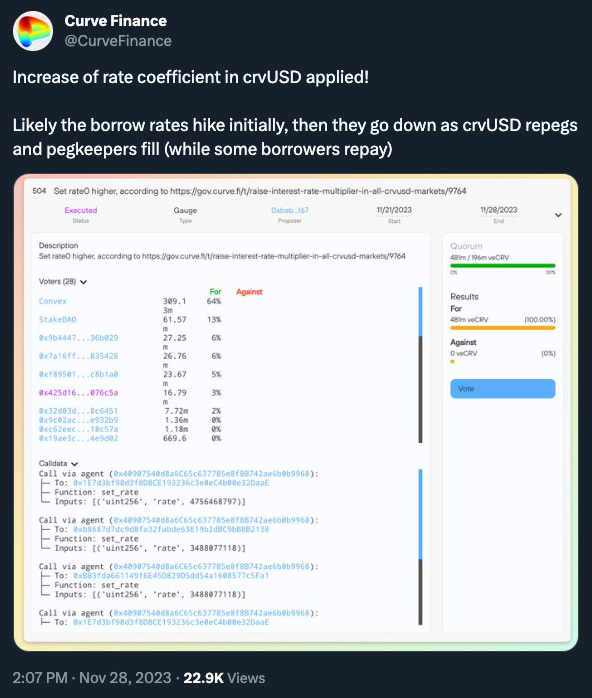

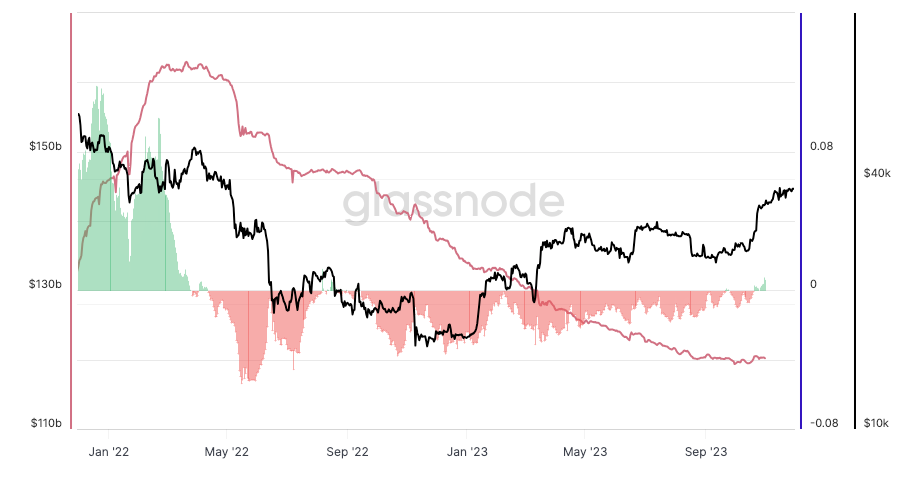

Victim of its success, with great yield opportunities flourishing in all corners of the space, $crvUSD started slightly deviating from peg (we are talking about less than 1% deviation) while also reaching ATH supply over 150M.

The Curve team monitored the situation and submitted a proposal to increase the borrow rate multiplier to the DAO, which passed and was implemented on 28 November.

Borrowing rates subsequently jumped to over 20% on some collateral types, which is helping restore the peg. Despite those very high rates, borrowers are not dramatically rushing to close or repay their loans because of yield opportunities balancing the borrowing rates but also thanks to the serenity that the LLAMA “soft liquidation” mechanism brings. $crvUSD continues to reveal its magic, maturing while demonstrating it is going to be a serious contender in the upcoming stablecoin war.

It is also interesting to notice the continuation of the expansion trend of the global stablecoin supplies generally associated with increased demand, and capital inflows into the digital asset space. And Conic is well positioned and getting ready to capture some of this.

Audits take time…

With Conic being a complex system, it is granted that security is a top priority. Prioritizing security means delayed times to ship as proper audits cannot be rushed. For many coneheads who are eager for Conic v2, this can be a hard pill to swallow. Recently, some took it to ask Michael’s opinion and his answer was comforting:

We can’t decode all transmissions; droids are methodical and careful not to leak what is being worked on. But from what we get, there is a lot in store and 2024 will be good.

As Yoda once said:

“Patience you must have, my young Padawan. Have patience and all will be revealed.“