In this latest transmission, we look at the most recent LAVs, the conclusion of the Llamas mint, the ETH Omnipool genesis vote, the beginning of the crvUSD Omnipool and its post-launch TVL growth.

First June LAVs Wrap Up

The first LAV of June ended on the 6th, with 1 $vICNC able to directly control $62.82 of liquidity.

The updated distribution of each of the following pools is as follows:

USDC POOL

FRAX+3Crv — 31.24%DAI+USDC+USDT — 29.44%FRAX+USDC — 26.68%MIM+3Crv — 7.99%DAI+USDC+USDT+sUSD — 4.65%

DAI POOL

DAI+UDSC+USDT — 48.33%FRAX+3Crv — 38.26%MIM+3Crv — 7.99%DAI+USDC+USDT+sUSD — 5.42%

FRAX POOL

FRAX+3Crv — 48.49%FRAX+USDC — 42.88%FRAX+USDP — 8.63%

USDT POOL

DAI+USDC+USDT — 50.71%FRAX+3Crv — 41.88%MIM+3Crv — 7.41%

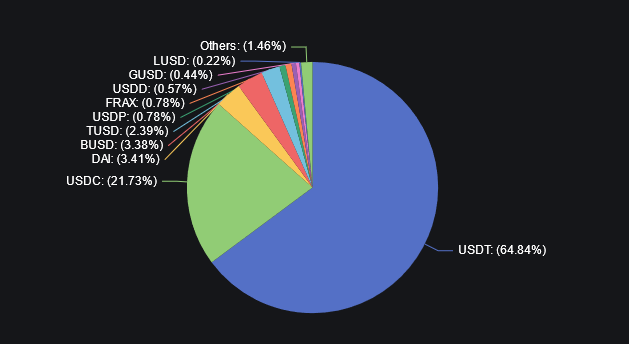

crvUSD POOL

USDC+crvUSD — 40.37%USDT+crvUSD — 40.35%USDP+crvUSD — 9.69%TUSD+crvUSD — 9.58%

The latest LAV update shows the biggest gainer and loser were both in the USDT Omnipool, DAI+USDC+USDT gained 177bps, and MIM+3Crv lost 332bps, respectively.

You’ll also notice this was the first crvUSD liquidity allocation vote, with initial Genesis weights being decided by vICNC holders. As such, we’ll have to wait till the subsequent transmission to see how liquidity is re-directed amongst the pools;

However, at a glance, you’ll notice both USDC and USDT as the most dominant which isn’t surprising considering their significantly higher stablecoin market share.

Following on 0xDaesu dropped his overview thread for the latest LAVs, touching on the launch of crvUSD Omnipool and the first LAV with over $100m of liquidity:

CrvUSD Omnipool Goes Live + $10m+ TVL 🚀

On June 9th, the crvUSD Omnipool officially launched; there was a slight delay—of two days—with the original launch planned for the 6th.

Unfortunately, this was caused by an enforced on-chain governance delay, which required the addition of another oracle for crvUSD—out of the Conic Team’s hands—nevertheless, once the oracle was in place, the team wasted no time deploying the new Omnipool, and initial APRs well over 40%.

This must have caught the Llamas and Curve fanatics' attention because shortly after, there was a surge in crvUSD minting.

A surge that saw crvUSD Omnipool TVL breaching the $10m mark, with 38% of the total supply deposited into Conic within the first 48 hours.

It hasn’t slowed either, with the Omnipool TVL growing to over $27m this week alone. All the crvUSD excitement led to another Conic TVL all-time high (of $131.5m to be precise.)

Yesterday, we highlighted that the amount deposited in the crvUSD Omnipool grew from 38% to 60% of the total supply—yes, you heard that correctly—total supply.

Given current market conditions, it’s really worth highlighting the performance of crvUSD and the Omnipool, as the growth has been outstanding.

It will definitely be interesting to see both the updated minted total supply and the subsequent amount deposited in the Omnipool by the next transmission.

Llamas Mint Ends

Firstly congratulations to the Llamas, whose auctions came to an end on the 11th. The team managed to raise over 1600 ETH—during a bear market, no less—which will be used for investing in the curve ecosystem. This, along with the previous grants from various Curve ecosystem protocols, they have a great foundation and proof of liquidity, which can be seen on Debank:

So what’s next for the Llamas? According to the team, they’ve been cooking up a lot of things and will have bigger announcements in the coming days.

One announcement—made before the auction’s conclusion—is the Llamas’ first project partnership with JPAGE, an on-chain, zero-fee, digital collectable marketplace with up to 75% cheaper gas costs. The underlying tech JPTs (the primitive) can house existing nfts or collections can be launched natively.

As a primitive, a whole ecosystem can (and will) be built on top of it. The project is native to the LLamas and its community will be living here in LLamas Country.

When the JPAGE network launches, the Llamas treasury will receive an allocation, and the team is inviting any community Llamas to do whatever they can to help the JPAGE team build some groundbreaking stuff.

If you want to learn more about JPAGE or ask the team questions about the underlying technology, they are hosted as a Sub-DAO within the Llamas discord.

CAP Whitelisting ETH Vote + Genesis Weights

On the 9th, a vote went live to determine the whitelisted pools the ETH Omnipool will launch with. In addition to this, Conic’s bb8 dropped a post on discourse covering the ETH Omnipool roll-out process, which has been slightly different.

How did it differ? The team decided to skip a vote to add an ETH Omnipool;

Why? It’s well known that the community have wanted an ETH Omnipool since the original Omnipools launched, and we knew there would always be an ETH version eventually. So, it makes complete sense to bypass a redundant ‘yes’ vote which would ultimately delay the launch of the Omnipool.

A couple of other important points raised by bb8, were that the ETH Omnipool was under audit and the scope of said audit covered supporting volatile, or non-pegged, assets for Conic Omnipools as well.

The initial underlying ETH assets included in the vote are ETH+stETH, ETH+cbETH, ETH+rETH). No non-ETH pegged assets are supported in this new Omnipool, but he mentioned they could potentially be supported in their own distinct Omnipool(s) in future.

With voting concluding on the 14th, this meant that the ETH Omnipool genesis weightings would be decided in the latest LAVs which kicked off a day later on the 15th.

With four days still remaining in the vote, vICNC is nearing quorum and ETH+stETH is leading with a massive 65.9% of the vote.

We might see these numbers shift, perhaps slightly, but a balanced distribution is unlikely considering the vast controlling TVL share of ETH LSDs Lido has.