Jan 27 - Attack of the Threadooors

The Threadooor army is moving throughout the Galaxy, but fret not Conic Finance and the Coneheads are steadfast in their mission of liberating the Galaxy!

Conelink’s latest de-coded transmission looks at the recent Governance discussions, votes and Conic’s feature in—possibly—the longest Twitter thread the Galaxy has ever seen, or at least will see in 2023.

Gauge Distribution Voting Concludes

On Jan 16th, voting concluded for the Gauge Distribution. The vote was to decide future CNC emissions and how they should be distributed to incentivize liquidity in the CNC/ETH Curve pool once the Curve gauge goes live.

The options were:

Use CNC for both—1.2M (89.34%)

Use CNC as bribes—139K (10.46%)

Use CNC as extra rewards for LPs—2.7K (0.2%)

Over 1.3m vlCNC voted, and the most popular was for LPs to earn both CRV and CNC rewards, with CRV rewards being funded by CNC bribes to vICVX and veCRV holders.

LP Curve Pricing

Jan 17th saw a new thread drop by the Conic team’s 0xWicket, to address Conic’s pricing model for Curve LP tokens—it’s a question that has come frequently—this thread helps to explain why the team didn’t price curve LPs by multiplying the virtual price by the cost of the underlying asset to price. This methodology isn’t suitable for Conic, and 0xWicket breaks down the rationale as to why

He also references team member General Grievous’s pricing discussion on discourse (which we’ve highlighted before) from back in August 2022. If of interest, you can find the post here: https://gov.conic.finance/t/the-curve-lp-token-pricing-method/42

Bribes and Emissions

On January 19th, the Conic team launched another two follow-up votes, determining the recipients of CNC bribe distributions and emissions as the outcome of the Gauge voting we mentioned earlier. Over the past two weeks, representatives from Stake DAO and Paladin have been very vocal in the Conic discourse about why their platforms (VoteMarket and Paladin) would be the best choice to allocate CNC bribes. It’s been great to see two of the most prominent bribing players in the DeFi market engaging with the Coneheads, and it will be great to see how this progresses.

The results concluded with bribes being solely paid to vICVX holders and 60% of inflation being used for paying bribes. The remaining 40% will be distributed to CNC/ETH LPs.

Quorum was met in each vote with 1.1M CNC out of the required 266k, and the breakdown of the results was as follows:

On vote (1), the options were:

vlCVX holders—655K (59.78%)

Both—435K (39.74%)

veCRV holders—5.3K (0.48%)

and vote (2), the options were:

Bribes—609K (55.84%)

LPs of the CNC/ETH Curve pool—481K (44.16%)

The results concluded with bribes being solely paid to vICVX holders and 60% of inflation being used for paying bribes. The remaining 40% will continue to be distributed to CNC/ETH LPs.

Attack of the Threadooors

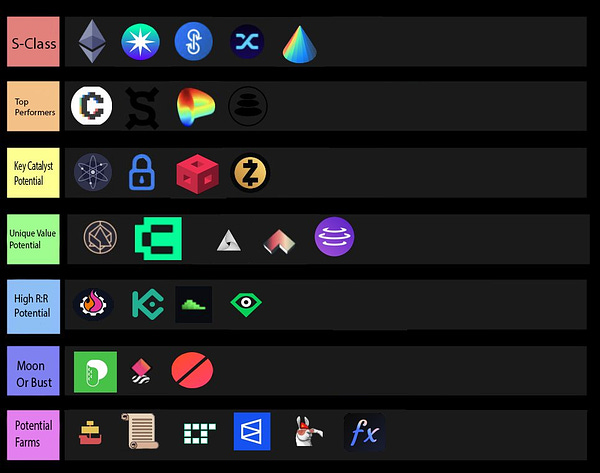

On Jan 18th Conic Finance was included in Adam Cochran’s 1/268 tweet thread—yes, you heard that right, two hundred and sixty-eight tweet thread—while we try to avoid shilling tweets when there is a detailed overview of the benefits of Conic, or how Omnipools will operate (see 0xRafi’s thread in the last transmission) we find it suitable to reference. Adam has a large audience, and it was great to see his prediction of S tier for Conic alongside Ethereum and other DeFi giants like Yearn and Synthetix. Although one could argue these are enormous shoes to fill… we’re confident that the team are taking all the necessary steps to bring the Conic Omnipool vision to life!

Curve and Convex were also included (understandably so) as Top Performers; we here at Cone Link expect great things from all three in the coming months after the release of crvUSD.

Curve Finance likes the Pool

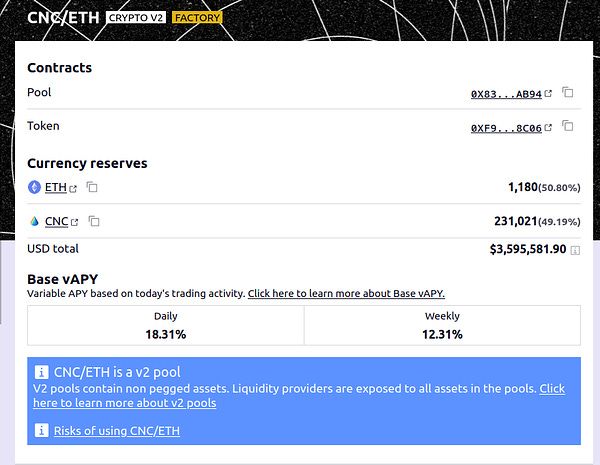

Curve Finance was impressed with the CNC/ETH liquidity pool; in the tweet below, they referred to how despite only $3.5m in total value locked, the pool provides $10k per week for the Conic DAO, which is 18% APY—very impressive—considering there is no gauge as of yet.

We already know with the subsequent votes spoken about above; there is a Gauge on the way, it will be exciting to see how much this increases in the coming weeks.

Llama Whale Alerts

On 20th January, Conic discord member Commander Cony announced his new llamawhalealert bot—which provides on-chain tracking across the Curve Finance ecosystem—a fantastic tool that has been added to the Conic discord server under #🦙-llama-alerts and if you’re a big believer in the Curve Ecosystem, we’d recommend a follow.