17th Nov: Prisma Airdrop and Boost, Intro to Napier Finance

V2 Teaser, Prisma airdrop and boost, Napier Finance appears, and CrvUSD doubling veCRV fees!

In this latest transmission, we look at: Conic V2 teaser drops, Prisma Airdrop and Boost, Intro to Napier Finance, 150M crvUSD supply and doubling of fees.

V2 Teaser

The first V2 teaser was dropped in the discord, this week, by none other than resident droid bb8. Now admittedly, this was just a GIF that was dropped in the discord, but it’s worth noting that this is similar to previous content the Conic Team has used for announcements.

This is a great indication that the team is preparing materials, docs, and announcements ready for launch—obviously, it’s worth noting that we’re still waiting on both audit reports, which are yet to be released. But this is a positive and could likely mean we begin to see more details about V2 rolling out in the next couple of weeks.

Keep your eyes peeled, Coneheads!

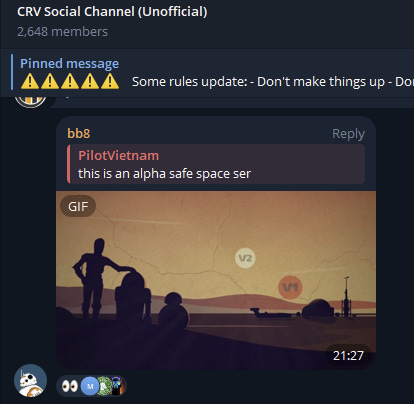

Prisma Airdrop & Boost

On November 6th, veCRV voters could claim their Prisma airdrop, which could be claimed in both cvxPRISMA and yPRISMA.

The wider community airdrop went live on the 9th, and in just 24 hours, 79% of airdropped $PRISMA was claimed.

Secured 1.485 million locked tokens. With nearly 59% of the circulating supply locked and 13.8% in the fee receiver, Prisma also hit a new milestone: $1.5 million in mkUSD in fees!

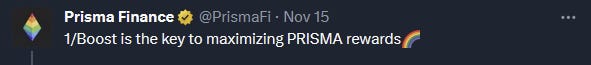

The Prisma team broke down Boost, a feature that can maximise PRISMA rewards—but how does it work?

Boosting is essential for maximizing rewards, and users with locked weight can benefit from boosted emissions, earning up to double the rate of unboosted rewards. This boost is directly tied to the user's PRISMA lock weight, and over a week, their claimable percentage with maximum boost is determined by their lock weight relative to the total lock weight.

As claims exceed the allowed amount, the boost gradually decreases from 2x to 1x and is recalculated weekly.

Highlighting Boost Delegation:

Locking your PRISMA also comes with the advantage of Boost Delegation. It allows those with lock weight to share their boost with others through delegation for a fee, enabling you to either rent out your boost or use someone else's boost to claim rewards with a bonus.

Napier Labs

On the 13th of November, we got the end game announcement of the Curve Ecosystem, from none other than Napier Labs.

Firstly, what is Napier? It serves as a liquidity hub focused on optimizing yield trading within the Curve ecosystem. Enabling users to employ versatile yield management strategies and welcomes the listing of various fixed-term assets on Napier (Curve).

The platform incentivizes market participation on Curve and Convex Finance, creating a capital-efficient ecosystem where liquidity providers can earn trading fees, CRV, CVX, and Napier's native token in addition to staking or lending yields.

$1m Seed Round

Michael Egorov (Curve Finance) and other prominent figures are among the seed investors of this new protocol which makes sense given—fixed yields market gaining serious momentum—the success of Pendle Finance leading the way.

Napier chose to leverage Curve pools for enhanced capital efficiency in yield trading. Their NPR token employs the veToken model, offering governance participants control over various protocol aspects.

The Protocol will act as a pioneering liquidity hub, extending the capabilities of Curve Finance, and primarily focusing on yield trading. It equips users with versatile strategies for yield management and effectively harnesses liquidity flows across pools for fixed-term tokens.

How it works

There are two core components: the Napier Minting System and the Napier AMM. The former can convert yield-bearing tokens into fixed-income equivalents, achieved through a process known as yield stripping.

Yield stripping results in the creation of Principal Tokens (PTs), representing fixed-income assets, and Yield Tokens (YTs), entitling holders to variable yield from the underlying asset. This allows for seamless conversion between fixed and variable yield assets, offering users enhanced flexibility.

The AMM operates through a nested AMM structure, facilitating yield trading between PTs, YTs, and their respective underlying assets within Base Pools. Time-dependent Metapools introduce a time parameter, enabling the trading of fixed-term tokens on Curve Finance. This allows users to trade various fixed-term tokens through the Curve pool, thereby enhancing the protocol's utility.

What are the advantages?

The alignment with Curve Finance is a big one, utilizing Curve v2 AMM for the base pool. This offers concentrated liquidity.

Single-sided staking is also enabled, providing a user-friendly and passive LP experience while maintaining high capital efficiency for traders.

With its innovative features, Napier aims to become a universal benchmark for maintaining reasonable interest rates and facilitating trading across a range of underlying assets, ultimately offering a game-changing solution in the yield derivative field.

We’re excited to see more from the team, especially if they have similar success to Prisma—and who knows if there is a potential partnership later down the road with Conic.

CrvUSD Supply and Doubling of the fees

On the 10th of November, we saw the crvUSD stablecoin supply hit 150M, a significant milestone. Founder Michael was aiming for 1bln by year-end, so still some ways to go in the next month and a half. Nevertheless, it’s great for the team and community, especially since how fees tie into crvUSD for veCRV holders.

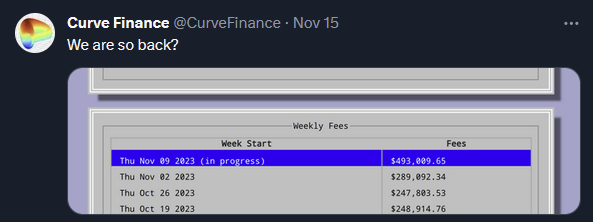

The Curve team highlighted the fees from the week of the 9th, which saw fees double from $289,092 the previous week to $493,009; this growth is going to have been supported by crvUSD—a sign of things to come as the market continues to heat up.

Once we see the V2 Omnipools re-launch, we hope to see the crvUSD demand return—as it previously offered the highest diversified crvUSD yield in the market—and we believe V2 won’t disappoint.